Announcer: You’re listening to Real Estate Investing Talks, a SimplyDoIt podcast. Your journey to success in real estate investment starts right here, right now. Here’s Dani Beit-Or.

Dani Beit-Or: Good morning. Good afternoon. Good evening. If you are on our live, feel free to do some likes and post some comments. It does help promote the live to others so they know something is going on, so that would be appreciated.

If you have questions regarding the topic today, then by all means, post them. That’s the whole point. I do those lives primarily to give an opportunity for Q&A, for a discussion and not just bring my own topic, although I always do.

I’m just going to start with a personal note. Not even 10 minutes ago, I received a link to a property that we are listing today in the Tampa area. This is a flip and probably my biggest flip ever– maybe not ever, but it’s one of the biggest flips I’ve ever done.

The property is a nice looking house. Let me just put it this way, a really nice house on one acre in one of the Tampa suburbs. It took about three and a half months to renovate. 200,000 each, a little bit over 200,000 to afford. Finally, it is listed as of about 10 minutes ago, so we are live with this property.

The hard part is over. Now we only need to sell it. Fingers crossed, but I’m very, very excited because it’s a really nice piece of real estate. It’s one that I wouldn’t have minded keeping for myself. It’s a beautiful house, large house, so I’m excited about that.

We are not here to talk about the flip of this house today. I just wanted to mention it because that just happened not even 10 minutes ago or just about 10 minutes ago. What I want to talk about today is about something that comes up in my discussions with investors, beginner and experienced, every once in a while.

It’s maybe not the most concerning topic, but it’s up there, probably around the top 10 that I hear quite a lot. That’s actually the fact that if you’re looking to buy multiple properties, should you buy them in one area or should you actually diversify? I’m just going to tell you how I came to the conclusion how to go about it myself.

When I started some 16 years ago and more picked up the pace some 14 years ago, I thought my logic was “it’s good to diversify”. Let’s buy multiple properties. That’s still and was the game plan- and put them in many markets because if you put them in many areas, then you diversify.

If you put one in Oklahoma and one in Orlando and one in Dallas, then if something happens to the local economy, this area, the one property is in danger, and the others are not. That was the logic. That makes perfect sense to me. I think it still makes perfect sense.

By the way, if you have questions, feel free to post them. I’ll take them throughout or after. But when you have multiple properties, and I’m not talking about multiple “two or three or four”, I’m talking about much more than that, and you diversify and put those properties in areas around the country, while you’re trying to diversify and create some safety for yourself, and that makes a lot of sense, what my experience has been is you’re paying in a different way. You’re actually having a little bit of a penalty in a different way.

Let’s just say for a second you have 10 properties in 10 markets, one per market. That mostly means you are working with 10 different property management companies, Maybe seven. Maybe one is covering more than one. Maybe even seven property management companies, each managing one to two properties of your own, total 10 properties.

Now, when you work with multiple property management companies, your managerial supervision, administration time, increases. That means, to simplify, it will be much easier on you to work with one property management company in one area or maybe two areas, but interfacing into one company, one service provider in order to consolidate all your efforts instead of dealing with 10 or seven property management companies on the same number of properties.

I found that this is something that I’ve underestimated because every property management company has their own thing. They do things a little bit differently on that aspect and a little bit differently on this aspect. One is good with communication. One is good with accounting. One is good with posting photos. One is not. Everybody’s different. You have to maintain or support that relationship with all those companies.

My experience has been, a few years and multiple properties in, I realized while it’s not taking all of my time, it does take an extra burden than if I just had, let’s say, five properties in one metro and another five properties in another metro, two property management companies or so. That helps consolidate the efforts. There’s less noise in the system. The more service providers you need to supervise, the more noise in the system you have.

I just thought that I wanted to tone down the noise that is created by multiple property management companies and consolidate. I’ve grown into the realization that it’s probably better not to spread into 10 markets and 10 property management companies or so but actually consolidate. Maybe do five or less or more in one area with one property management company.

I think the risk of diversification or not diversification versus the effort that is required in maintaining multiple relationships is overtaking that risk of diversification. That’s just my take.

Now, sometimes people, when I tell them that, they say, “What is your number?” We just say, “Five per market, three per market, 10 per market.” That I don’t know. It’s a very personal question, very personal in the sense of what is your belief system? What is your inner understanding of the situation?

I have investors that do five before they move to another metro, and I have investors that do 10 before they move to another metro. That’s something where each one would be a little bit different.

Of course, we’ve got to put it in reality. Sometimes, even if our goal is to buy five in one area before we move over to another, then we may try to accomplish the purchase of five, but then we see after the fourth one, the market picked up, and it doesn’t make any sense to buy there anymore. We’ll move. It’s nothing set in stone.

The point I’m trying to make is don’t necessarily immediately come to the conclusion of, “I need to diversify, and I need to spread in multiple markets.” I’m not sure. There’s a lot of common sense to it but less common reality from the trenches or from the administrative side of it, so don’t make that assumption right off the bat.

Maybe, if you want to be a little bit less conservative or more conservative, I’ll say, “You know what? I’ll buy two per market and not five.” It’s a little bit easier. Just something to think about and not immediately have the intuition to diversify.

Now, if you’re buying three, and you say, “Listen. I don’t care. I’m only going to maintain three relationships with property managers,” that’s okay. That’s not a problem. That’s relatively easy. But, if you want to scale up, which I think most of my investors do, then that’s something you want to think about. That’s all I wanted to say about this. Don’t immediately assume you need to diversify in multiple markets.

Now, I see there’s a question coming in. What criteria do you choose when selecting which markets to focus on? Excellent question. Let me tell you. Good to see you, my friend, or I should say my distant cousin. This is a very good question. Let me give you my answer, the way I go about it.

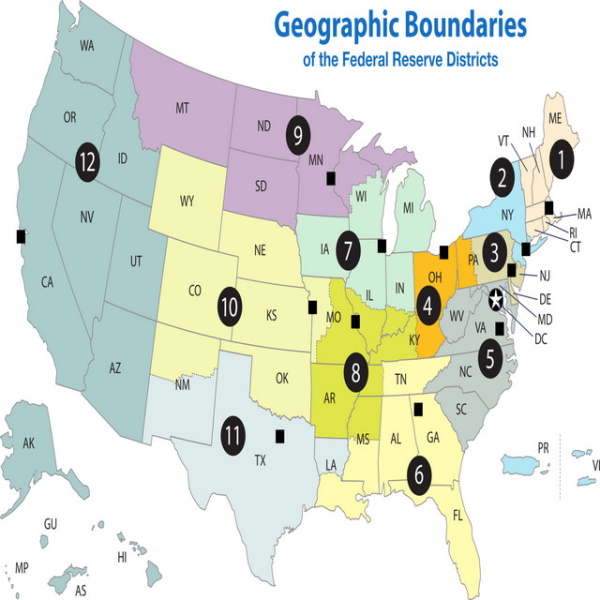

I have multiple criteria that I’m considering, and it goes like this. Number one is I want to go into a metro that the population is at least 1.5 million people and up. That means Oklahoma City works. Tampa works. Nashville works. Others, Dallas, Houston, no problem. That’s easy. That’s number one.

Number two, I like to go to metros that have diversification in terms of employment. That means multiple major employers, big employers, whatever they are- it could be government, and it could be construction, and it could be hospitality and banking– I want to say that there’s multiple big employers and representing multiple industries. It doesn’t have to be many industries but multiple industries. That means even if I go to an area–

Oklahoma City is a good example. I’m just using it as an example because it qualifies on all of those aspects although I think it has a little bit more exposure to the energy especially into the oil. When the oil price went down and stayed down for quite some time, Oklahoma City did suffer a little bit.

It didn’t crash, but you could see there was a correlation between the oil prices staying low for a period of time to the jobs, some of the jobs. The market still did well which makes Oklahoma City actually good, but it wasn’t completely resistant to the oil prices.

Oklahoma City actually passed the test of a little ding on the economy, but it’s not like it flew throughout without any hiccups. It didn’t. Even Houston had a little bit of hiccups, not a lot, when the oil prices went down. Again, it barely was really felt, but it was there.

The major adjustment that happened in 2016 when the oil prices went down in Houston is that the projection for job growth in 2016 was cut by half. That means instead of 160,000 jobs Houston was projected to add in 2016, it only had about half of that. Not bad, but that was the major adjustment right there, just to give you an example. I hope I’m not getting too technical or too detailed.

We talked about metro size, representation of multiple industries and major employers. I like to follow the demographic patterns, and demographic patterns in the US, if you go back, and if you project into the future, you will see that there is a lot of migration going from the Midwest and some of the Northeast down to the southern states and the west.

You can see that pattern has been going on for quite some time. If you go to our website simplydoit.net and look for migration patterns or search for that, you’ll see that we are getting every year at the beginning of the year one of the bigger home movers in the United States.

Those guys don’t do local moves. They do the big rigs across the country. They track how many moves they had from one state versus how many moves they had to another state and they say, in 2016, Texas had seen more people moving in than people moving out, just as an example.

We have that. If you all had similar tracking. You can see that there is a trend going to the southern states. If you think about the southern states as a growth, if you’re buying a house for a rental, and you’re going to hold it for many years- five to 10 to 15, you want to go into an area that is showing growth patterns.

I want to have, consistently, buyers and renters coming in rather than going to an area that is shrinking. It’s obvious, but people still don’t follow those trends. They just follow more herd. I see more and more people or a lot of people that are following the herd. They’re not following the trend.

The trend I’m talking about is not what’s going on at the moment. In the demographic pattern on a long-term investment, following a one-year pattern or trend, that’s not really a good thing to do. Otherwise, I would buy in South Dakota near the oil rigs, and now everything crashed. I didn’t for that reason. Long-term demographic trends is important.

Of course, prices, how much I can buy and how much I can rent for, that’s very, very important. I want to make sure I can still buy for a reasonable amount of money, and it will rent.

Let me give you two examples. In Dallas, I can find a decent house for 175,000 in a good area that will probably rent for, let’s say, 1600/1650 a month. That’s something I can do, again, in a good area. 175,000, a three-two, probably 10/15 years old with a two car garage in A-schools/B-schools, very cookie-cutter boring community in the suburbs. That would be in Dallas which followed that type of a trend.

If you go to Portland which has a good trend of migration in– so Portland is on the path for growth migration. Absolutely Oregon sees an increase in migration and has a lot of everything that I talked about earlier in the places I would consider to buy. Portland fits that bill.

The only problem I have in Portland, I wish I didn’t, but the only problem, I just did another analysis on Portland a week ago, $350,000-ish home, maybe 300, gets rented for 2000, maybe 2500. Even with 25%, I can’t make the numbers work. It’s still going to be small, negative cash flow. That’s, for me, a problem.

I really tried to find– I did an optimistic analysis, not trying to see why Portland wouldn’t work. I did 25% down, and I estimated lower prices than what actually people are asking, a little bit higher rent. I really massaged it to a positive outlook, and I just couldn’t make the numbers work. It’s still going to be 300-ish and up, and the cash flow is not there. Portland is great. It follows everything except one thing, the cash flow or the numbers.

Lastly, I will probably say I like to go to areas along the country that the laws are favoring the landlord. If I get into a situation of an eviction, I want to be able to do it quickly and cheaply so I can put the house back in a producing position as quickly as possible.

Now, that’s trivial to think, but some states around the country, that’s not the case. California is not very friendly to homeowners, on the contrary. Usually, the rule of thumb is this. You go to a blue state, a democratic state, typically, the laws are going to be favoring the tenant. If you go to a red state, a republican state, it’s the other way around.

I had a few evictions in my career. It usually took about maybe 10 days to two weeks and cost anywhere from– the cheapest one was probably $215, and the most expensive one was probably $670, and that’s including the sheriff and the locksmith, so I spent even a little bit more. That, for me, is critical. I want to be able to get out of that house or out of that situation and put it back to a producing property.

Now, some people say, “Listen, how many evictions are you going to run into? What’s the big deal? You’re not facing evictions all the time.” That’s true, but think about the tenant for a second. If you are a tenant in a red state, and you know the setting is not in your favor, what would you do?

You’re probably not going to be favoring to cause any problems. You’re going to avoid it to begin with. If you are in an area that the setting is favoring you, and you know it’s going to give hard times to the owner, what is your mindset now?

Just to give you a little thinking about how I look at it, it’s not just eviction. It’s also what eviction laws are creating or the environment they’re setting up more for success. Those are the main things that I look into when I select an area around the country.

Any other questions? Sometimes it takes Facebook a minute to populate questions, so I’m just going to wait, and I’ll see if there are other questions related to the topic of today, not related to the topic of today, no problem. George, thank you for joining. If you like my answers, hit like. It will help others see.

Which metro did you first invest in? My first property I bought when I was a young person working for the corporate Israel, living in Tel Aviv, buying sight unseen completely remotely from Tel Aviv. I bought my first home in the metro Phoenix in one of the same cities, a brand new home from the builder 1500-ish, three-two, two car garage.

When I went there, eventually, when it was already built and rented, and I think I saw it for the first time maybe two and a half years after owning it, I drove down the street, and I could barely find my own house because they all look just the same. I mean, they really look just the same, which is fine. I don’t have a problem with it. It just makes me laugh every time, but that was a kind of interesting observation.

Great house. It did very, very well for me, that house. It was my first. It wasn’t easy to begin with. My first vacancy was 45 days which made me very, very nervous. I was going kind of nuts. I thought it was going to rent very quickly, like within a day. That’s what I thought. I don’t know why. That was a good investment altogether, so can’t complain altogether.

The first tenant to move in, the family, stayed there for five and a half years, so no complaints here. The house did very well because I bought it in 2002. Most of you know what happened in 2004/2005. That house did translate to at least four more houses.

Hi Shoshi, good to see you. Paz, hello. Good to see you. Thank you for joining. Let’s see. George- which metro is your favorite to invest in? George, this is an excellent question. I’m just going to say this. I have my own favorites. I can tell you right now, it changes. Right now, I really like Nashville, and I really like Tampa right now for me.

I want to emphasize. I am different than some of you guys in the sense of my experience, in the sense of my objectives, financially, all of those things, so when people ask me that question, I’m really hesitant to really give you an answer because if you based it on my answer, it may not be the right one for you.

Maybe, financially, you’re looking for something different. Maybe, financially, you cannot afford– I don’t know you, but let’s say you cannot afford Nashville. It’s too expensive. I’m a little bit hesitant to give you a clear cut answer.

The way I work with investors is when we work together, we help decide together which of the markets we are in are best suitable for their needs, not for my needs because it’s not about me. It’s about the investor.

I gave an answer because he asked, but I want you also to take it with caution and not immediately think, “Oh, this is the right one for you.” It could be, but obviously, I don’t know you at all. Thank you for asking to give you an honest opinion. If we talk one-on-one, I’ll be happy to provide you with an honest opinion relevant to you, not to me.

What is your take on commercial properties, and are you working on such markets as well? When you talk about a loan on commercial properties, do you mean like shopping centers, office buildings, or are you more referring to, let’s say, multifamily units like small apartment buildings? Yes, all. Okay. Alright, thanks.

Honestly, I’ve been a single family-owned junkie for all my career. I’ll be very honest. I’ve done a little bit of commercial, very, very small commercial. Every time I say it, I feel like I’m not being– It’s so small, I can’t even say I really did commercial. I don’t consider it really investing in commercial because it’s a small thing.

Personally, I’m not a big fan of commercial buildings such as offices, strip malls, stuff like that just because either the price point– It’s just not my comfort zone. I have done I think a duplex maybe once or twice. I can’t remember exactly, but I was a very big fan of just single family homes most of my career, and I’m now shifting over to multi-family. We are under contract right now for nine buildings in Indianapolis.

Honestly, I would say it’s probably 20 times more challenging to decide what to do with this building than a single family home. So if I want an easy life, single-family home. Easy, simple, straightforward. If I want a complicated life, obviously multi-building it is. That’s number one.

Number two, the reason I stayed and I still am very much a single family home junkie for flipping and rentals because we do both is because, in the US, the US economy is very much dependent on households.

Households in the US, for the most part, live in single-family homes. I know some of you are maybe in the San Francisco Bay Area or other parts of the country that, in real estate, is quite expensive, and that’s not really the case.

If someone here is from the Bay area, they’re taking my answers like, “What are you talking about? People here live in condos, in townhomes and stuff like that, and that’s actually what most people–” Right. In the Bay Area, you’re absolutely right. Move the Bay Area out of that equation because it’s an exception and other areas around the country.

When you take the San Francisco Bay Area, when you take New York City and maybe a few other pockets and you say those are not representing because they represent about 20,000,000 people in the US, where are all the 320/330,000,000 other people live? Not all of them is single family homes, but the big majority of them.

Even LA is mostly single family or a lot of single family on a huge metro. When you’re talking about a single family home, it’s a very stable financial vehicle. It’s a very liquid relatively type of real estate.

Go out and sell your multifamily, your commercial building. It may take you a year, maybe three. I don’t know. Go out and sell your single family home. It could take a year, but probably, if it’s taking a year, there’s probably something wrong with how you’re listing it, the price, something is wrong. Usually, it doesn’t take that long.

Obviously, when you put a single family home for sale, the market of potential buyers is huge. When you put even a 20 unit building, even a 15 unit building for sale, the market is very small. Relatively, it’s very small. It’s not very liquid.

Single family homes tend to be very good with liquidity relatively to real estate to sustain– When things crash, the economy crashes, the people at the office, they’re kind of scanning down and saying, “You know what? Let’s rent a smaller office space. And you know what? Let’s all move to our home offices, and we meet once a week in a WeWork or something like that.” People can scale back home, and they will drop out of the office. We would see that.

By the way, the last crash proved that. That for me creates less of a safety environment. I’m not against it, but I’m not a big fan of that. I want to be liquid. If you own a multifamily and you need some cash, it’s hard to liquidate a portion of a multifamily. It’s very easy to liquidate one or two properties from your portfolio of single family homes.

That’s just advantages and disadvantages. I’m not saying it’s right or wrong. I’m just saying things to consider when you’re thinking about it. Hopefully, that helps you with your question. Thank you for the question.

Would you buy a house for $50,000? What is the biggest problem with the cheaper single family houses? Excellent question. Let me answer it in a very complex way. Would I buy a house for $50,000 in today’s market? Probably not. You know what? No. Never say never, but no. Now, let me tell you why.

Again, I’m not saying it’s wrong. It’s all about your objective. Typically, when you buy around this country a $50,000 home, it looks like this, typically, not very good area or neighborhood to begin with.

Not necessary all crime or drug dealers on the street. Still, not a very good household income in your area. Low grade school, older home, smaller home. For me, that’s a recipe to invite a lot of noise in your life. When I say noise in your life, I want my investments to be in what we do for investors to be as much as possible “buy and forget”. Now, it’s not a buy and forget methodology.

When I say “buy and forget”, ideally, I want to buy a house, not deal with anything, collect the rent checks until, one day, I want to sell it. That would be the “buy and forget” ideal. It doesn’t exist. There’s always something going on. Tenant moves in. Tenant moves out. House is vacant. There is a repair. There is this. That’s the noise that comes with ownership.

The question I have for you, Paz, that you’re asking, how much of that noise do you want? Because when you buy the cheaper house, the smaller house in a lower income area– low-er, not low. Lower income area.

There’s a very good chance you have more noise coming from the property and the tenant. Not always, but there’s a very good chance versus you buy the nice house for $100,000 more, let’s just say or maybe even $50,000 more, and you buy that house in a nice community, good schools.

It attracts the type of tenant that has good income, not necessary wealthy but good, stable income, good job. Many times, both of them work, with the kids. It’s big enough to have the kids and the parents and the dog, and they’re sending their kids to school. That creates somewhat of a stability.

Again, it’s not a guarantee that it will have no issue, but it’s a higher chance that you will avoid potential issues that are based on financial. For me, that’s a very attractive proposition. I call it the most boring type of real estate. The more boring, the more I like it. I’m not sure what you said in your comment with None. Maybe you can elaborate. I don’t know what it means, but hopefully, that helps.

By the way, don’t think for a second that I have the right answer and you have the wrong one by going to 50,000. Not at all. That’s quite alright. I know people do that. It’s just a different way to go about it. That’s the only difference. It’s not right or wrong. Again, it’s what’s your objectives. I want noise-free.

I have two cheap houses, by the way. I have because one day I decided I needed to do an experiment. Seriously, I just did an experiment. I call it my own R&D. I bought two cheap houses in a working class in Oklahoma City. Right now, two/two and a half years in, I’m probably looking at, I would say, 20/25% vacancy rate. Nice houses. They’re not bad. They’re just not that attractive.

Right now, one has been vacant for three months maybe coming on four. The other one was also, so I wouldn’t say it’s a good area. It seems like every time a tenant moves out– By the way, in that period of time, I had one eviction already. Two houses, okay area, low class, not an excellent experience. It’s okay. I’m not too concerned about it.

Very good. Alright, good to see you, El Iran. Hope everything is okay. I’ll wait here for another minute or so to see if there are any additional questions. We’re getting great questions.

By the way, I’ll take this opportunity to say three things. Number one, we hold a live session, more of a Q&A, every week at this time, a weekly Friday. I know some of you are late at night, so we have that.

The second thing is I think I saw one or two of my investors meaning they’re already a client of ours, and I just want to tell you that at 12:30 California time, which is about an hour from now, we’re holding a closed session. A closed session is just for our active investors.

We started doing a weekly sessions for Q&A to see what’s the challenges. This is not open to the public. It’s only to the SimplyDoIt investors that are actively searching, actively looking, actively investing and have some challenges, so we’re doing a group session as well. Not live here. It’s in a different format.

If you’re one of my investors, and you did not receive the email, now you know. You can contact me or Kenny if you need the details how to join in one hour today. We will record it as well, so you can access it later.

Then, lastly, I’m just going to add a little appreciation from putting a link if you want to our ebook. Hey Kenny. Kenny is here as well. He’s my awesome assistant doing a great job. Thank you, Kenny for all the help. You’re awesome. You really are awesome.

I put a link to our ebook. It’s free. Simple read, not complicated, straightforward. Feel free to download it. If you’re downloading it, I’ll only ask you one thing. Give us a feedback. I don’t care how.

You want to put it online, perfect. You want to send it to me, personally, through whatever messaging system, I don’t care. I would love to get your feedback. If you’re reading and you want to take the trouble, a little appreciation, send us a feedback. Say, “Dani, I loved it. I didn’t. I didn’t read it.” I don’t care. I want to get the feedback, so that would be much appreciated.

If you’re on the recording, I’m just going to say, the ebook is simplydoit.net/ebook. I’m recording this as an audio as well so we can put it on our podcast. We have a podcast channel, and it’s there as well.

Perfect. I think plenty of announcements for now. I don’t see any additional questions coming in, so I want to thank everyone wherever you are on the globe, different time zones, I really appreciate it. Friday night, taking the time, that shows character. Friday night, real estate, not sitting with family. Awesome, guys.

If you have any specific questions that you want to talk to me, let me know. I’ll be happy to talk to you. I want to wish everyone a great weekend, and see you next week on the next live one week from now and maybe even sooner. Very good. Thank you, everyone. Have a good night. Have a good weekend. Bye-bye.

Announcer: Congratulations. You are one step closer to success in real estate investment. You’ve been listening to Real Estate Investing Talks with Dani Beit-Or. To learn how SimplyDoIt can guide you through the real estate investment process and achieve nationwide success, visit us on the web at simplydoit.net. Thanks for listening.

Announcer: You’re listening to Real Estate Investing Talks, a SimplyDoIt podcast. Your journey to success in real estate investment starts right here, right now. Here’s Dani Beit-Or.

Dani Beit-Or: Good morning. Good afternoon. Good evening. If you are on our live, feel free to do some likes and post some comments. It does help promote the live to others so they know something is going on, so that would be appreciated.

If you have questions regarding the topic today, then by all means, post them. That’s the whole point. I do those lives primarily to give an opportunity for Q&A, for a discussion and not just bring my own topic, although I always do.

I’m just going to start with a personal note. Not even 10 minutes ago, I received a link to a property that we are listing today in the Tampa area. This is a flip and probably my biggest flip ever– maybe not ever, but it’s one of the biggest flips I’ve ever done.

The property is a nice looking house. Let me just put it this way, a really nice house on one acre in one of the Tampa suburbs. It took about three and a half months to renovate. 200,000 each, a little bit over 200,000 to afford. Finally, it is listed as of about 10 minutes ago, so we are live with this property.

The hard part is over. Now we only need to sell it. Fingers crossed, but I’m very, very excited because it’s a really nice piece of real estate. It’s one that I wouldn’t have minded keeping for myself. It’s a beautiful house, large house, so I’m excited about that.

We are not here to talk about the flip of this house today. I just wanted to mention it because that just happened not even 10 minutes ago or just about 10 minutes ago. What I want to talk about today is about something that comes up in my discussions with investors, beginner and experienced, every once in a while.

It’s maybe not the most concerning topic, but it’s up there, probably around the top 10 that I hear quite a lot. That’s actually the fact that if you’re looking to buy multiple properties, should you buy them in one area or should you actually diversify? I’m just going to tell you how I came to the conclusion how to go about it myself.

When I started some 16 years ago and more picked up the pace some 14 years ago, I thought my logic was “it’s good to diversify”. Let’s buy multiple properties. That’s still and was the game plan- and put them in many markets because if you put them in many areas, then you diversify.

If you put one in Oklahoma and one in Orlando and one in Dallas, then if something happens to the local economy, this area, the one property is in danger, and the others are not. That was the logic. That makes perfect sense to me. I think it still makes perfect sense.

By the way, if you have questions, feel free to post them. I’ll take them throughout or after. But when you have multiple properties, and I’m not talking about multiple “two or three or four”, I’m talking about much more than that, and you diversify and put those properties in areas around the country, while you’re trying to diversify and create some safety for yourself, and that makes a lot of sense, what my experience has been is you’re paying in a different way. You’re actually having a little bit of a penalty in a different way.

Let’s just say for a second you have 10 properties in 10 markets, one per market. That mostly means you are working with 10 different property management companies, Maybe seven. Maybe one is covering more than one. Maybe even seven property management companies, each managing one to two properties of your own, total 10 properties.

Now, when you work with multiple property management companies, your managerial supervision, administration time, increases. That means, to simplify, it will be much easier on you to work with one property management company in one area or maybe two areas, but interfacing into one company, one service provider in order to consolidate all your efforts instead of dealing with 10 or seven property management companies on the same number of properties.

I found that this is something that I’ve underestimated because every property management company has their own thing. They do things a little bit differently on that aspect and a little bit differently on this aspect. One is good with communication. One is good with accounting. One is good with posting photos. One is not. Everybody’s different. You have to maintain or support that relationship with all those companies.

My experience has been, a few years and multiple properties in, I realized while it’s not taking all of my time, it does take an extra burden than if I just had, let’s say, five properties in one metro and another five properties in another metro, two property management companies or so. That helps consolidate the efforts. There’s less noise in the system. The more service providers you need to supervise, the more noise in the system you have.

I just thought that I wanted to tone down the noise that is created by multiple property management companies and consolidate. I’ve grown into the realization that it’s probably better not to spread into 10 markets and 10 property management companies or so but actually consolidate. Maybe do five or less or more in one area with one property management company.

I think the risk of diversification or not diversification versus the effort that is required in maintaining multiple relationships is overtaking that risk of diversification. That’s just my take.

Now, sometimes people, when I tell them that, they say, “What is your number?” We just say, “Five per market, three per market, 10 per market.” That I don’t know. It’s a very personal question, very personal in the sense of what is your belief system? What is your inner understanding of the situation?

I have investors that do five before they move to another metro, and I have investors that do 10 before they move to another metro. That’s something where each one would be a little bit different.

Of course, we’ve got to put it in reality. Sometimes, even if our goal is to buy five in one area before we move over to another, then we may try to accomplish the purchase of five, but then we see after the fourth one, the market picked up, and it doesn’t make any sense to buy there anymore. We’ll move. It’s nothing set in stone.

The point I’m trying to make is don’t necessarily immediately come to the conclusion of, “I need to diversify, and I need to spread in multiple markets.” I’m not sure. There’s a lot of common sense to it but less common reality from the trenches or from the administrative side of it, so don’t make that assumption right off the bat.

Maybe, if you want to be a little bit less conservative or more conservative, I’ll say, “You know what? I’ll buy two per market and not five.” It’s a little bit easier. Just something to think about and not immediately have the intuition to diversify.

Now, if you’re buying three, and you say, “Listen. I don’t care. I’m only going to maintain three relationships with property managers,” that’s okay. That’s not a problem. That’s relatively easy. But, if you want to scale up, which I think most of my investors do, then that’s something you want to think about. That’s all I wanted to say about this. Don’t immediately assume you need to diversify in multiple markets.

Now, I see there’s a question coming in. What criteria do you choose when selecting which markets to focus on? Excellent question. Let me tell you. Good to see you, my friend, or I should say my distant cousin. This is a very good question. Let me give you my answer, the way I go about it.

I have multiple criteria that I’m considering, and it goes like this. Number one is I want to go into a metro that the population is at least 1.5 million people and up. That means Oklahoma City works. Tampa works. Nashville works. Others, Dallas, Houston, no problem. That’s easy. That’s number one.

Number two, I like to go to metros that have diversification in terms of employment. That means multiple major employers, big employers, whatever they are- it could be government, and it could be construction, and it could be hospitality and banking– I want to say that there’s multiple big employers and representing multiple industries. It doesn’t have to be many industries but multiple industries. That means even if I go to an area–

Oklahoma City is a good example. I’m just using it as an example because it qualifies on all of those aspects although I think it has a little bit more exposure to the energy especially into the oil. When the oil price went down and stayed down for quite some time, Oklahoma City did suffer a little bit.

It didn’t crash, but you could see there was a correlation between the oil prices staying low for a period of time to the jobs, some of the jobs. The market still did well which makes Oklahoma City actually good, but it wasn’t completely resistant to the oil prices.

Oklahoma City actually passed the test of a little ding on the economy, but it’s not like it flew throughout without any hiccups. It didn’t. Even Houston had a little bit of hiccups, not a lot, when the oil prices went down. Again, it barely was really felt, but it was there.

The major adjustment that happened in 2016 when the oil prices went down in Houston is that the projection for job growth in 2016 was cut by half. That means instead of 160,000 jobs Houston was projected to add in 2016, it only had about half of that. Not bad, but that was the major adjustment right there, just to give you an example. I hope I’m not getting too technical or too detailed.

We talked about metro size, representation of multiple industries and major employers. I like to follow the demographic patterns, and demographic patterns in the US, if you go back, and if you project into the future, you will see that there is a lot of migration going from the Midwest and some of the Northeast down to the southern states and the west.

You can see that pattern has been going on for quite some time. If you go to our website simplydoit.net and look for migration patterns or search for that, you’ll see that we are getting every year at the beginning of the year one of the bigger home movers in the United States.

Those guys don’t do local moves. They do the big rigs across the country. They track how many moves they had from one state versus how many moves they had to another state and they say, in 2016, Texas had seen more people moving in than people moving out, just as an example.

We have that. If you all had similar tracking. You can see that there is a trend going to the southern states. If you think about the southern states as a growth, if you’re buying a house for a rental, and you’re going to hold it for many years- five to 10 to 15, you want to go into an area that is showing growth patterns.

I want to have, consistently, buyers and renters coming in rather than going to an area that is shrinking. It’s obvious, but people still don’t follow those trends. They just follow more herd. I see more and more people or a lot of people that are following the herd. They’re not following the trend.

The trend I’m talking about is not what’s going on at the moment. In the demographic pattern on a long-term investment, following a one-year pattern or trend, that’s not really a good thing to do. Otherwise, I would buy in South Dakota near the oil rigs, and now everything crashed. I didn’t for that reason. Long-term demographic trends is important.

Of course, prices, how much I can buy and how much I can rent for, that’s very, very important. I want to make sure I can still buy for a reasonable amount of money, and it will rent.

Let me give you two examples. In Dallas, I can find a decent house for 175,000 in a good area that will probably rent for, let’s say, 1600/1650 a month. That’s something I can do, again, in a good area. 175,000, a three-two, probably 10/15 years old with a two car garage in A-schools/B-schools, very cookie-cutter boring community in the suburbs. That would be in Dallas which followed that type of a trend.

If you go to Portland which has a good trend of migration in– so Portland is on the path for growth migration. Absolutely Oregon sees an increase in migration and has a lot of everything that I talked about earlier in the places I would consider to buy. Portland fits that bill.

The only problem I have in Portland, I wish I didn’t, but the only problem, I just did another analysis on Portland a week ago, $350,000-ish home, maybe 300, gets rented for 2000, maybe 2500. Even with 25%, I can’t make the numbers work. It’s still going to be small, negative cash flow. That’s, for me, a problem.

I really tried to find– I did an optimistic analysis, not trying to see why Portland wouldn’t work. I did 25% down, and I estimated lower prices than what actually people are asking, a little bit higher rent. I really massaged it to a positive outlook, and I just couldn’t make the numbers work. It’s still going to be 300-ish and up, and the cash flow is not there. Portland is great. It follows everything except one thing, the cash flow or the numbers.

Lastly, I will probably say I like to go to areas along the country that the laws are favoring the landlord. If I get into a situation of an eviction, I want to be able to do it quickly and cheaply so I can put the house back in a producing position as quickly as possible.

Now, that’s trivial to think, but some states around the country, that’s not the case. California is not very friendly to homeowners, on the contrary. Usually, the rule of thumb is this. You go to a blue state, a democratic state, typically, the laws are going to be favoring the tenant. If you go to a red state, a republican state, it’s the other way around.

I had a few evictions in my career. It usually took about maybe 10 days to two weeks and cost anywhere from– the cheapest one was probably $215, and the most expensive one was probably $670, and that’s including the sheriff and the locksmith, so I spent even a little bit more. That, for me, is critical. I want to be able to get out of that house or out of that situation and put it back to a producing property.

Now, some people say, “Listen, how many evictions are you going to run into? What’s the big deal? You’re not facing evictions all the time.” That’s true, but think about the tenant for a second. If you are a tenant in a red state, and you know the setting is not in your favor, what would you do?

You’re probably not going to be favoring to cause any problems. You’re going to avoid it to begin with. If you are in an area that the setting is favoring you, and you know it’s going to give hard times to the owner, what is your mindset now?

Just to give you a little thinking about how I look at it, it’s not just eviction. It’s also what eviction laws are creating or the environment they’re setting up more for success. Those are the main things that I look into when I select an area around the country.

Any other questions? Sometimes it takes Facebook a minute to populate questions, so I’m just going to wait, and I’ll see if there are other questions related to the topic of today, not related to the topic of today, no problem. George, thank you for joining. If you like my answers, hit like. It will help others see.

Which metro did you first invest in? My first property I bought when I was a young person working for the corporate Israel, living in Tel Aviv, buying sight unseen completely remotely from Tel Aviv. I bought my first home in the metro Phoenix in one of the same cities, a brand new home from the builder 1500-ish, three-two, two car garage.

When I went there, eventually, when it was already built and rented, and I think I saw it for the first time maybe two and a half years after owning it, I drove down the street, and I could barely find my own house because they all look just the same. I mean, they really look just the same, which is fine. I don’t have a problem with it. It just makes me laugh every time, but that was a kind of interesting observation.

Great house. It did very, very well for me, that house. It was my first. It wasn’t easy to begin with. My first vacancy was 45 days which made me very, very nervous. I was going kind of nuts. I thought it was going to rent very quickly, like within a day. That’s what I thought. I don’t know why. That was a good investment altogether, so can’t complain altogether.

The first tenant to move in, the family, stayed there for five and a half years, so no complaints here. The house did very well because I bought it in 2002. Most of you know what happened in 2004/2005. That house did translate to at least four more houses.

Hi Shoshi, good to see you. Paz, hello. Good to see you. Thank you for joining. Let’s see. George- which metro is your favorite to invest in? George, this is an excellent question. I’m just going to say this. I have my own favorites. I can tell you right now, it changes. Right now, I really like Nashville, and I really like Tampa right now for me.

I want to emphasize. I am different than some of you guys in the sense of my experience, in the sense of my objectives, financially, all of those things, so when people ask me that question, I’m really hesitant to really give you an answer because if you based it on my answer, it may not be the right one for you.

Maybe, financially, you’re looking for something different. Maybe, financially, you cannot afford– I don’t know you, but let’s say you cannot afford Nashville. It’s too expensive. I’m a little bit hesitant to give you a clear cut answer.

The way I work with investors is when we work together, we help decide together which of the markets we are in are best suitable for their needs, not for my needs because it’s not about me. It’s about the investor.

I gave an answer because he asked, but I want you also to take it with caution and not immediately think, “Oh, this is the right one for you.” It could be, but obviously, I don’t know you at all. Thank you for asking to give you an honest opinion. If we talk one-on-one, I’ll be happy to provide you with an honest opinion relevant to you, not to me.

What is your take on commercial properties, and are you working on such markets as well? When you talk about a loan on commercial properties, do you mean like shopping centers, office buildings, or are you more referring to, let’s say, multifamily units like small apartment buildings? Yes, all. Okay. Alright, thanks.

Honestly, I’ve been a single family-owned junkie for all my career. I’ll be very honest. I’ve done a little bit of commercial, very, very small commercial. Every time I say it, I feel like I’m not being– It’s so small, I can’t even say I really did commercial. I don’t consider it really investing in commercial because it’s a small thing.

Personally, I’m not a big fan of commercial buildings such as offices, strip malls, stuff like that just because either the price point– It’s just not my comfort zone. I have done I think a duplex maybe once or twice. I can’t remember exactly, but I was a very big fan of just single family homes most of my career, and I’m now shifting over to multi-family. We are under contract right now for nine buildings in Indianapolis.

Honestly, I would say it’s probably 20 times more challenging to decide what to do with this building than a single family home. So if I want an easy life, single-family home. Easy, simple, straightforward. If I want a complicated life, obviously multi-building it is. That’s number one.

Number two, the reason I stayed and I still am very much a single family home junkie for flipping and rentals because we do both is because, in the US, the US economy is very much dependent on households.

Households in the US, for the most part, live in single-family homes. I know some of you are maybe in the San Francisco Bay Area or other parts of the country that, in real estate, is quite expensive, and that’s not really the case.

If someone here is from the Bay area, they’re taking my answers like, “What are you talking about? People here live in condos, in townhomes and stuff like that, and that’s actually what most people–” Right. In the Bay Area, you’re absolutely right. Move the Bay Area out of that equation because it’s an exception and other areas around the country.

When you take the San Francisco Bay Area, when you take New York City and maybe a few other pockets and you say those are not representing because they represent about 20,000,000 people in the US, where are all the 320/330,000,000 other people live? Not all of them is single family homes, but the big majority of them.

Even LA is mostly single family or a lot of single family on a huge metro. When you’re talking about a single family home, it’s a very stable financial vehicle. It’s a very liquid relatively type of real estate.

Go out and sell your multifamily, your commercial building. It may take you a year, maybe three. I don’t know. Go out and sell your single family home. It could take a year, but probably, if it’s taking a year, there’s probably something wrong with how you’re listing it, the price, something is wrong. Usually, it doesn’t take that long.

Obviously, when you put a single family home for sale, the market of potential buyers is huge. When you put even a 20 unit building, even a 15 unit building for sale, the market is very small. Relatively, it’s very small. It’s not very liquid.

Single family homes tend to be very good with liquidity relatively to real estate to sustain– When things crash, the economy crashes, the people at the office, they’re kind of scanning down and saying, “You know what? Let’s rent a smaller office space. And you know what? Let’s all move to our home offices, and we meet once a week in a WeWork or something like that.” People can scale back home, and they will drop out of the office. We would see that.

By the way, the last crash proved that. That for me creates less of a safety environment. I’m not against it, but I’m not a big fan of that. I want to be liquid. If you own a multifamily and you need some cash, it’s hard to liquidate a portion of a multifamily. It’s very easy to liquidate one or two properties from your portfolio of single family homes.

That’s just advantages and disadvantages. I’m not saying it’s right or wrong. I’m just saying things to consider when you’re thinking about it. Hopefully, that helps you with your question. Thank you for the question.

Would you buy a house for $50,000? What is the biggest problem with the cheaper single family houses? Excellent question. Let me answer it in a very complex way. Would I buy a house for $50,000 in today’s market? Probably not. You know what? No. Never say never, but no. Now, let me tell you why.

Again, I’m not saying it’s wrong. It’s all about your objective. Typically, when you buy around this country a $50,000 home, it looks like this, typically, not very good area or neighborhood to begin with.

Not necessary all crime or drug dealers on the street. Still, not a very good household income in your area. Low grade school, older home, smaller home. For me, that’s a recipe to invite a lot of noise in your life. When I say noise in your life, I want my investments to be in what we do for investors to be as much as possible “buy and forget”. Now, it’s not a buy and forget methodology.

When I say “buy and forget”, ideally, I want to buy a house, not deal with anything, collect the rent checks until, one day, I want to sell it. That would be the “buy and forget” ideal. It doesn’t exist. There’s always something going on. Tenant moves in. Tenant moves out. House is vacant. There is a repair. There is this. That’s the noise that comes with ownership.

The question I have for you, Paz, that you’re asking, how much of that noise do you want? Because when you buy the cheaper house, the smaller house in a lower income area– low-er, not low. Lower income area.

There’s a very good chance you have more noise coming from the property and the tenant. Not always, but there’s a very good chance versus you buy the nice house for $100,000 more, let’s just say or maybe even $50,000 more, and you buy that house in a nice community, good schools.

It attracts the type of tenant that has good income, not necessary wealthy but good, stable income, good job. Many times, both of them work, with the kids. It’s big enough to have the kids and the parents and the dog, and they’re sending their kids to school. That creates somewhat of a stability.

Again, it’s not a guarantee that it will have no issue, but it’s a higher chance that you will avoid potential issues that are based on financial. For me, that’s a very attractive proposition. I call it the most boring type of real estate. The more boring, the more I like it. I’m not sure what you said in your comment with None. Maybe you can elaborate. I don’t know what it means, but hopefully, that helps.

By the way, don’t think for a second that I have the right answer and you have the wrong one by going to 50,000. Not at all. That’s quite alright. I know people do that. It’s just a different way to go about it. That’s the only difference. It’s not right or wrong. Again, it’s what’s your objectives. I want noise-free.

I have two cheap houses, by the way. I have because one day I decided I needed to do an experiment. Seriously, I just did an experiment. I call it my own R&D. I bought two cheap houses in a working class in Oklahoma City. Right now, two/two and a half years in, I’m probably looking at, I would say, 20/25% vacancy rate. Nice houses. They’re not bad. They’re just not that attractive.

Right now, one has been vacant for three months maybe coming on four. The other one was also, so I wouldn’t say it’s a good area. It seems like every time a tenant moves out– By the way, in that period of time, I had one eviction already. Two houses, okay area, low class, not an excellent experience. It’s okay. I’m not too concerned about it.

Very good. Alright, good to see you, El Iran. Hope everything is okay. I’ll wait here for another minute or so to see if there are any additional questions. We’re getting great questions.

By the way, I’ll take this opportunity to say three things. Number one, we hold a live session, more of a Q&A, every week at this time, a weekly Friday. I know some of you are late at night, so we have that.

The second thing is I think I saw one or two of my investors meaning they’re already a client of ours, and I just want to tell you that at 12:30 California time, which is about an hour from now, we’re holding a closed session. A closed session is just for our active investors.

We started doing a weekly sessions for Q&A to see what’s the challenges. This is not open to the public. It’s only to the SimplyDoIt investors that are actively searching, actively looking, actively investing and have some challenges, so we’re doing a group session as well. Not live here. It’s in a different format.

If you’re one of my investors, and you did not receive the email, now you know. You can contact me or Kenny if you need the details how to join in one hour today. We will record it as well, so you can access it later.

Then, lastly, I’m just going to add a little appreciation from putting a link if you want to our ebook. Hey Kenny. Kenny is here as well. He’s my awesome assistant doing a great job. Thank you, Kenny for all the help. You’re awesome. You really are awesome.

I put a link to our ebook. It’s free. Simple read, not complicated, straightforward. Feel free to download it. If you’re downloading it, I’ll only ask you one thing. Give us a feedback. I don’t care how.

You want to put it online, perfect. You want to send it to me, personally, through whatever messaging system, I don’t care. I would love to get your feedback. If you’re reading and you want to take the trouble, a little appreciation, send us a feedback. Say, “Dani, I loved it. I didn’t. I didn’t read it.” I don’t care. I want to get the feedback, so that would be much appreciated.

If you’re on the recording, I’m just going to say, the ebook is simplydoit.net/ebook. I’m recording this as an audio as well so we can put it on our podcast. We have a podcast channel, and it’s there as well.

Perfect. I think plenty of announcements for now. I don’t see any additional questions coming in, so I want to thank everyone wherever you are on the globe, different time zones, I really appreciate it. Friday night, taking the time, that shows character. Friday night, real estate, not sitting with family. Awesome, guys.

If you have any specific questions that you want to talk to me, let me know. I’ll be happy to talk to you. I want to wish everyone a great weekend, and see you next week on the next live one week from now and maybe even sooner. Very good. Thank you, everyone. Have a good night. Have a good weekend. Bye-bye.

Announcer: Congratulations. You are one step closer to success in real estate investment. You’ve been listening to Real Estate Investing Talks with Dani Beit-Or. To learn how SimplyDoIt can guide you through the real estate investment process and achieve nationwide success, visit us on the web at simplydoit.net. Thanks for listening.